Interference by insurers is driving psychological well being care suppliers to flee networks. It makes remedy exhausting to search out. Some states are passing legal guidelines to guard sufferers.

Javi Sanz/Getty Photographs/E+

conceal caption

toggle caption

Javi Sanz/Getty Photographs/E+

Accessing psychological well being care is usually a harrowing ordeal. Even when a affected person finds a therapist of their community, their insurance coverage firm can overrule that therapist and determine the prescribed remedy isn’t medically crucial.

This sort of interference is driving psychological well being professionals to flee networks, which makes remedy exhausting to search out and places sufferers in hurt’s manner.

ProPublica sought to grasp what authorized protections sufferers have towards insurers impeding their psychological well being care.

This story comes from ProPublica, a nonprofit newsroom that investigates abuses of energy. Signal as much as obtain their largest tales as quickly as they’re printed.

Most People — greater than 164 million of them — have insurance policy by way of employers. These are usually regulated by federal legislation.

Though the legislation requires insurers to supply the identical entry to psychological well being care as to bodily care, it doesn’t require them to rely on evidence-based tips or these endorsed by skilled societies in figuring out medical necessity. As an alternative, when deciding what to pay for, the federal government permits insurers to set their very own requirements.

“If insurers are allowed to dwelling bake their very own medical necessity requirements, you’ll be able to just about guess that they’re going to be contaminated by monetary conflicts of curiosity,” stated California psychotherapist and legal professional Meiram Bendat, who specializes in defending entry to psychological well being remedy.

Federal lawmakers who wish to enhance affected person protections may look to their counterparts in states who’re pioneering stronger legal guidelines.

Though these state legal guidelines govern solely plans below state jurisdiction, similar to particular person or small-group insurance policies bought by way of state marketplaces, consultants advised ProPublica they may, when enforced, function a mannequin for broader laws.

“States are laboratories for innovation,” stated Lauren Finke, senior director of coverage at The Kennedy Discussion board, a nonprofit that has advocated for state laws that improves entry to psychological well being care. “States can take it ahead and use it for proof of idea, after which that may completely be mirrored on the federal stage.”

ProPublica reporters delved into the legal guidelines in all 50 states to find out how some try to chart new paths to safe psychological well being care entry.

Lots of the new protections are solely simply beginning to be enforced, however ProPublica discovered that a couple of states have begun punishing corporations for violations and forcing them into compliance.

Who defines what psychological well being care is critical?

Insurers usually face few limitations on how they outline what sort of psychological well being care is medically crucial. They usually create their very own inside requirements as a substitute of counting on ones developed by nonprofit skilled medical societies. These requirements can then be used to problem diagnoses or remedy plans.

“Understanding the revenue motive that insurers have, it’s actually stunning that federal legislation doesn’t outline medical necessity and require the usage of nonprofit tips to make choices,” stated Bendat, who helped California legislators draft a extra strong legislation that handed in 2020, turning into one of many first states to take action.

California’s legislation requires insurers to comply with usually accepted requirements of care for psychological well being and substance use situations, forcing them to depend on evidence-based sources that set up standards, similar to nonprofit skilled organizations or peer-reviewed research. The state additionally barred insurers from protecting solely the remedy of short-term or acute signs, similar to disaster stabilization, as a substitute of the underlying situation, like persistent despair.

Final October, California discovered well being care group Kaiser Permanente in violation of the brand new state legislation and different well being care laws, reaching a settlement with the corporate, which agreed to pay a $50 million high-quality and make $150 million in investments in behavioral well being care. A Kaiser spokesperson stated that the corporate takes full accountability for its efficiency and that it had adopted new tips in keeping with the legislation. (Learn their full response.)

A spokesperson for the state’s Division of Managed Well being Care stated the company is auditing insurers and figuring out whether or not their networks supply sufficient suppliers to serve prospects and whether or not they ship well timed entry to care.

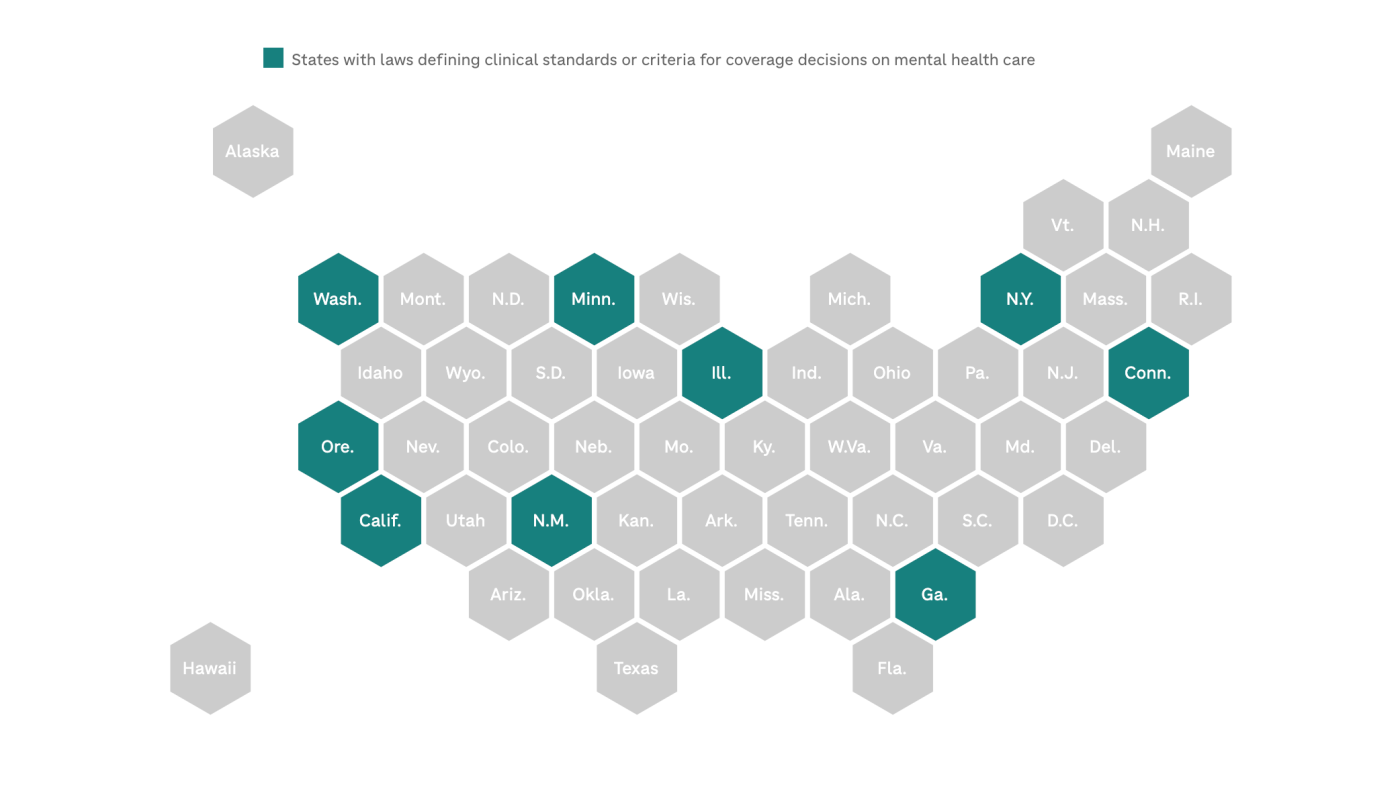

9 states, together with Oregon, Illinois and Georgia, have outlined the scientific requirements or standards that insurers should use when making protection choices on psychological well being care.

Amid the opioid disaster, which has killed greater than one million People, states have additionally instituted medical necessity protections for substance use remedy. For instance, in Colorado, Maryland, Delaware, Connecticut and several other different states, insurers should depend on tips from the American Society of Habit Medication when reviewing remedies for substance use.

How can insurers problem psychological well being remedy?

Earlier than 2008, insurance coverage corporations nationwide may put extra stringent limits on how usually sufferers acquired psychological well being care in contrast with medical care, instituting extra restrictive caps on the variety of remedy periods per yr or the size of a keep at an inpatient facility.

The federal Psychological Well being Parity and Habit Fairness Act banned these tougher limits. So insurers shifted to a unique method to deny care. “They’re not going to only cowl limitless care, in order that they should do one thing to restrict utilization,” stated Tim Clement, the vp of federal authorities affairs on the nonprofit group Psychological Well being America.

Insurers say they conduct what they name utilization evaluations, by which they will request and sift by way of remedy progress notes stuffed with delicate particulars, to evaluate whether or not suppliers are delivering acceptable care. Nonetheless, suppliers, psychological well being care advocates and legislators have discovered that these evaluations are sometimes used as pretexts by insurers on the lookout for a cause to dispute the need of remedy.

In recent times, not less than 24 states have handed laws to attempt to regulate how insurers conduct evaluations of behavioral well being care.

After the New York legal professional basic decided that insurers, together with EmblemHealth, Excellus and MVP, had violated state and federal legal guidelines with their evaluations, state legislators bolstered oversight of those processes in 2019. An Excellus spokesperson stated it had since adopted a number of reforms; MVP didn’t reply to ProPublica’s questions, and EmblemHealth forwarded a response from a managed well being plan commerce group known as the New York Well being Plan Affiliation, which stated that the state’s findings don’t mirror the business’s present practices. (Learn their full responses.)

The New York legislation requires insurers to depend on standards based mostly on proof and authorized by the state when scrutinizing care. Peer reviewers, who work for insurance coverage corporations to assess medical necessity or appropriateness of care, have to be licensed suppliers with related experience in psychological well being. And with regards to youngsters, insurers are usually prohibited from requiring preapproval for his or her psychological well being remedy or conducting evaluations through the first two weeks of an inpatient keep.

Final yr, New York regulators discovered that Cigna’s and Wellfleet’s medical necessity standards have been out of compliance with the brand new legislation. The insurers are allowed to maintain working whereas they work with the state to convey their standards in keeping with the legislation, in keeping with the state’s psychological well being workplace. (The businesses didn’t reply to requests for remark.)

A number of states, similar to Massachusetts, New Mexico and Hawaii, make insurers speak in confidence to sufferers and suppliers the factors or insurance policies that they depend on for evaluations.

Insurers often choose the clinician conducting evaluations, however in Illinois, if there’s a disagreement in regards to the necessity of a remedy, a affected person can go for one other scientific reviewer, collectively chosen by the affected person, their supplier and the insurer.

Some states have additionally restricted the frequency of evaluations. In Delaware, insurers are usually prohibited from reviewing inpatient substance use remedy within the first 14 days. In Kentucky and Ohio, for sufferers with autism, insurers can’t request multiple evaluation yearly for outpatient care.

What should insurers reveal about psychological well being care entry?

It may be exhausting to implement the legal guidelines requiring equitable protection for psychological and bodily situations; doing so entails evaluating very completely different sorts of well being care and efficiently arguing there may be an imbalance in entry. State and federal regulators even have minimal sources for such intensive examinations, which has hindered their means to scrutinize insurers.

To carry insurers accountable, not less than 31 states and the District of Columbia have handed legal guidelines requiring them to report how a lot entry they actually present to psychological well being care.

Most of those states ask insurers to offer particulars on their remedy standards or limitations, however some states seem like violating their very own legal guidelines by not posting info publicly.

New Jersey’s Division of Banking and Insurance coverage, for instance, should make an insurer criticism log publicly out there and submit an insurance coverage compliance report associated to psychological well being care. However no such info has been printed on its web site greater than 5 years after the state handed this requirement.

After ProPublica requested in regards to the lack of transparency, spokesperson Daybreak Thomas stated that the division is working to implement the necessities and that the reporting course of would start this yr. “We acknowledge that the reporting provisions within the legislation present vital public perception into compliance of carriers,” she advised ProPublica in an e-mail.

Chris Aikin, a spokesperson for the unique invoice’s main sponsor, New Jersey Meeting Speaker Craig Coughlin, advised ProPublica his workplace had been in touch with the division and would “monitor their progress to fulfill reporting necessities and guarantee full transparency for shoppers.”

For compliance experiences, states usually request information and analyses from insurers, however the figures that insurers submit will not be detailed and even correct.

“I’ve reviewed a whole lot of these analyses,” stated Clement, who has helped advocate for larger insurer transparency in a number of states, “and in most states, they’re fairly dangerous.”

However in some states, like Oregon, the place detailed annual reporting is required, analyses revealed a disproportionate variety of insurance coverage claims for behavioral well being have been out-of-network in contrast with medical claims, suggesting that individuals might have confronted bother accessing therapists coated by their insurance policy.

Its experiences additionally discovered that psychological well being suppliers have been paid considerably lower than medical suppliers for workplace visits of equal size. For an hourlong workplace go to, a psychological well being supplier was, on common, reimbursed about half the quantity given to a medical or surgical clinician. A spokesperson for the state’s Division of Client and Enterprise Providers advised ProPublica that there have been no investigations or enforcement actions in response to the brand new necessities.

“There’s no manner we will really feel assured that anybody is following the legislation except we make certain there may be accountability they usually should show that they’re accountable,” Clement stated.

Different states, like New York, have begun to make use of the brand new information to drive investigations. Since 2021, the state’s Division of Monetary Providers has performed 9 investigations of seven insurance coverage corporations in response to the legal guidelines, in keeping with a division spokesperson.

Individuals can file complaints with their state insurance coverage departments in the event that they consider that an insurer is violating their rights.

This story comes from ProPublica, a nonprofit newsroom that investigates abuses of energy.

Share your story: You probably have submitted a criticism to a state insurance coverage division that you just want to share with ProPublica reporters, attain out at mentalhealth@propublica.org.

ProPublica reviewed legal guidelines and laws in all 50 states and the District of Columbia. For those who see a state legislation that was not included, please ship them a observe.

Max Blau of ProPublica contributed analysis to this report. Maps by NPR’s Connie Hanzhang Jin.